Auto Insurance in Tulsa, Oklahoma

What separates Cheapest Auto Insurance in Tulsa from other auto insurance companies?

We have made auto insurance easy and hassle free. With our Anonymous Quoting System that is the fastest online auto insurance quoting process in the industry, a customer can receive a quote in 60 seconds and complete the entire policy online in 5 minutes. There is truly nothing like it in the auto insurance industry. Here are few other reasons why Cheapest Auto Insurance is the place to find hassle-free, affordable auto insurance in Tulsa.

- No Credit Checks

- No Middleman Fees

- State of the art APP

- Low First Month Payment

- Anonymous Quoting System

Whether you visit one of our retail offices, call our call center, or use one of our self-service options, Cheapest Auto Insurance is happy to help you take care of your auto insurance needs in Tulsa today!

We love Tulsa, Oklahoma!

Tulsa isn’t just a place on the map — it’s a city with serious personality. With a population of around 411,000 people, Tulsa hits the sweet spot: big enough for exciting opportunities and entertainment, but friendly enough that it still feels like home.

Known for its rich oil and aviation history, stunning Art Deco architecture, and legendary music roots, Tulsa blends history with fresh energy. Spend a Saturday exploring the Gathering Place (one of the best parks in the country), strolling through the Philbrook Museum of Art, or hopping around the Blue Dome District for food and nightlife. And speaking of food — from classic Oklahoma BBQ to globally inspired cuisine, Tulsa’s dining scene punches way above its weight.

Thinking about relocating? Tulsa makes it easy to say yes. The nationally recognized Tulsa Remote program even offers financial incentives for remote workers to move here, helping new residents plug into the community from day one. Pair that with affordable living, welcoming neighborhoods, and miles of River Parks trails, and it’s easy to see why so many people are choosing Tulsa.

Want to learn more? Explore the official Tulsa tourism site and local relocation resources to start planning your move. We’ll save you a seat

Once you’re here, getting settled is a breeze — especially when it comes to utilities. You can set up water service through the City of Tulsa, electric service through Public Service Company of Oklahoma (PSO), and natural gas through Oklahoma Natural Gas. With a few quick sign-ups, you’ll be ready to kick back and start enjoying your new home.

What kind of auto insurance do I need in Tulsa?

Insurance in Tulsa

Driving around Tulsa is a whole lot more fun when you’re covered (and legal). Like the rest of Oklahoma, Tulsa drivers are required to carry minimum liability auto insurance to help cover injuries or damages if you’re involved in an accident. This coverage is designed to protect everyone on the road — and it’s not optional.

Oklahoma law requires drivers to have at least $25,000 / $50,000 /$25,000 for bodily injury and property damage liability. That means if you cause an accident, your insurance helps pay for the other person’s medical bills and vehicle repairs.

Oklahoma also uses an electronic insurance verification system, which means the state can flag vehicles that appear to have lapsed coverage. If you receive a Notice of No Insurance, don’t panic — you can usually take care of it online through the Oklahoma Uninsured Vehicle Enforcement Diversion (UVED) program website.

For official insurance rules and updates, you can also visit the Oklahoma Insurance Department website. They’re a great resource for understanding coverage requirements, consumer rights, and what to do if you run into insurance issues.

Staying insured keeps you protected, stress-free, and ready for the next Tulsa adventure.

Learn more about Tulsa Auto Insurance

- Click here to read about auto insurance coverage in Tulsa

- Click here to watch about the importance of keeping auto insurance active

- Click here to learn more about your auto insurance policy

- Click and read about the importance of carrying proper auto insurance in Tulsa

- Click and read more about finding cheap auto insurance in Tulsa

Liability Auto Insurance in Tulsa

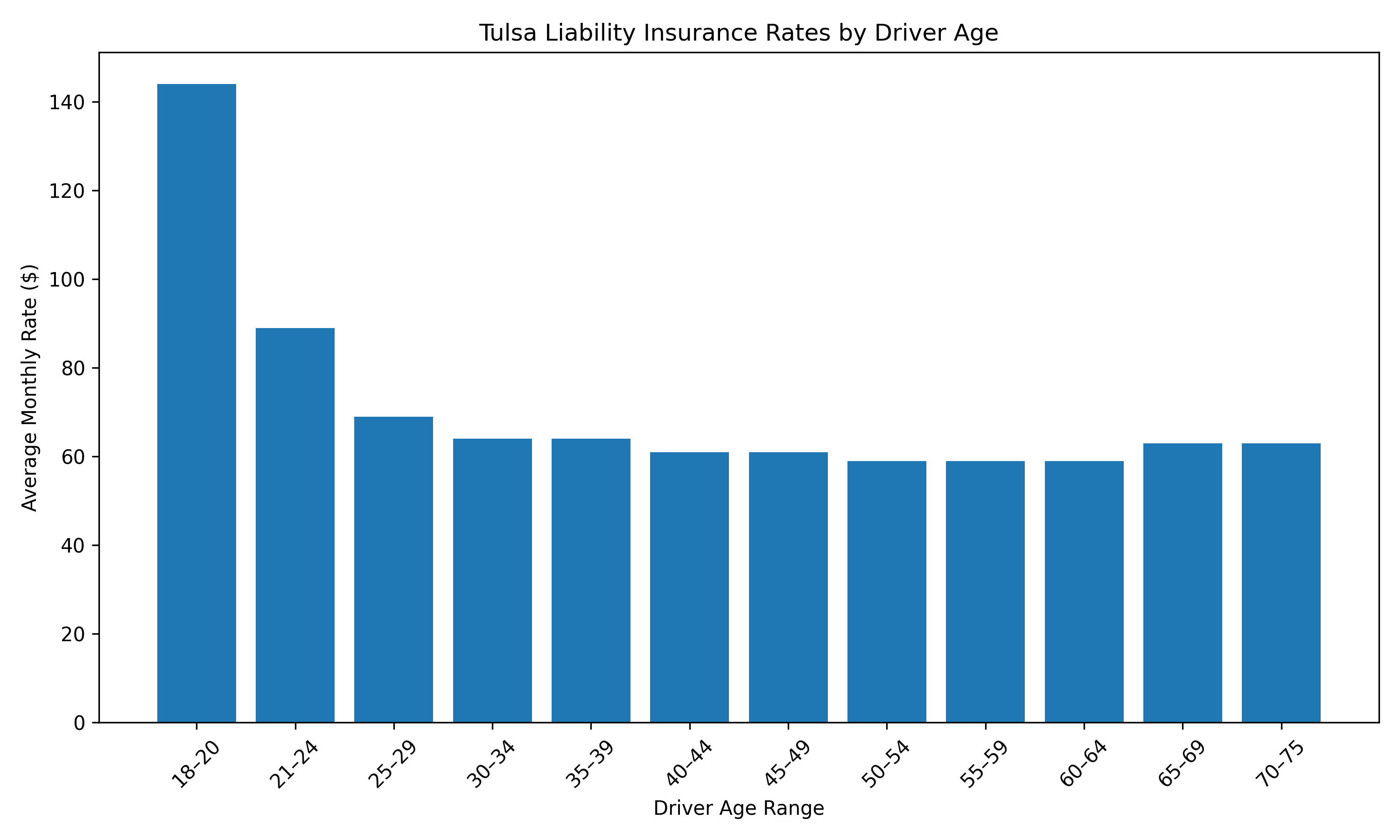

Liability auto insurance in Tulsa is among the most expensive in Oklahoma. Here at Cheapest Auto Insurance, we can help you get the basic liability limits that Oklahoma requires which is 25/50/25 which is what we specialize in. Liability car insurance rates are based on several different factors here are a few main one's insurance companies in Tulsa use to set their rating factors:

- Insurance History

- Age

- Driving Record

- Credit Score

Check out this video to understand more about Liability Auto Insurance

Most of the nonstandard auto insurance companies in Tulsa do not run credit that is more of a factor with the larger national carriers the do more preferred insurance. Driving record seems to be one of the most important factors insurance companies use when rating liability insurance policies. Most of the nonstandard insurance companies only offer the state minimum coverage of 25/50/25. The higher your liability limits are the more it will cost you monthly. So, most consumers usually take the state minimum limits so they can save money on their monthly premiums.

Please remember that if you purchase liability only auto insurance it will only cover damage you do to a 3rd party; it will not pay for damage done to your vehicle. If you want your vehicle covered in case of an accident you would need to purchase full coverage insurance. Full coverage insurance is usually about twice the price as liability only. So, it is important to prioritize which is more important saving monthly or having extra coverage that could come in handy in case of accident.

Click to learn more about cheap liability car insurance.

Understanding More About Cheap Liability Car Insurance

- Watch and learn more about cheap liability car insurance

- Click and learn more about liability only car insurance in Tulsa

Full Coverage Car Insurance in Tulsa

If you’re paying for full coverage car insurance Oklahoma drivers commonly choose, you might be wondering whether it still makes financial sense in 2026.

With premiums rising, unpredictable storm seasons, and many vehicles aging on the road, more drivers across the state are evaluating whether keeping collision and comprehensive coverage is worth the cost — or if switching to liability-only insurance is the smarter move.

This guide will help you decide.

Click here to learn more about Full Coverage auto insurance in Tulsa

How to get cheap auto insurance quotes in Tulsa

Cheapest Auto Insurance wants to help you find the best auto insurance quote possible. When searching for auto insurance you will see lots of advertisements from insurance companies. So here are a few ways you can help find cheap car insurance in a fast efficient way.

- Find an auto insurance broker that works with many different insurance companies so you can find the best rate.

- Find an online quote comparison site that can shop online for you searching through a large amount of insurance companies.

- Find an insurance company that fits your coverage needs and current situation.

- Ask for every possible discount you can.

- Set your policy up on auto pay for your monthly premiums

- Set your billing up on Paperless Billing.

- Try to bundle your homeowners' policy or renter's policy with your auto insurance policy for the multi policy discount.

Check out this video to learn more about how auto insurance companies set their rates

Tips on how to lower your auto insurance rates in Tulsa

It is wise to always try to take advantage of all the discounts possible when you are trying to save on your car insurance rates. Here are a few discounts you can ask for when getting auto insurance quotes:

- Set your billing up on EFT

- Sign up for Paperless billing

- Some auto insurance companies offer a 7-10% discount for taking a defensive driving course.

- Be sure to shop around on your renewal to make sure your current insurance policy still works for you.

- Try to keep an even number of cars and drivers on your policy.

To go a little further on the last discount we mentioned and explain why this is so important. Auto insurance companies like this because it appears as that you have disclosed everyone who has access to drive your vehicles. Undisclosed drivers cost insurance companies a large amount of money each year by having accidents. Auto insurance companies want to be able to underwrite all drivers that are driving a vehicle to provide the appropriate monthly prices.

Want to find out how you can lower your car insurance in Tulsa? Check out this resource to find out!

Click to read more about car insurance in Tulsa. Check out this video to understand why auto insurance rates go up after an accident

Auto insurance Companies in Tulsa

There are several car insurance companies in Tulsa to choose from. When searching for the best one for your needs, be sure to read reviews from customers. Firsthand knowledge is usually a good gage on how the insurance company handles their business. Most insurance companies in Tulsa are either holding rates steady this year and some are even dropping rates or giving customer rebates back due to the Covid-19 situation. As long as there are no more major CAT losses rates should hold steady. But if hurricanes or severe hail storms start coming in that definitely could raise car insurance prices in Tulsa.

Click here to learn more about the best auto insurance companies

Check here to learn how to find the best insurance companies!

How Does Non-Owners Insurance Work In Tulsa, Oklahoma?

Non Owners insurance can often be a confusing policy. On many of the policies in Oklahoma, companies will add an exclusion of coverage if the vehicle is driven on a regular basis for a long period of time.

According to the Department of Insurance, a "non-owner liability policy pays for damages and injuries you cause when driving a borrowed or rented car, but it doesn't pay for your injuries or damage to the car you are driving." Many customers use this coverage to simply get their license reinstated.

If you drive a vehicle on a regular basis and own the vehicle, it is best to actually insure that vehicle (rather than to purchase a non-owners insurance policy). Many times, Non-Owners Insurance is cheaper than a normal auto policy. That said, coverage is much more limited.

Watch this video to learn more about Non Owners Car Insurance

One of the things we do here at Cheapest Auto Insurance is help explain all your coverages so everyone can understand them. Feel free to give us a call at (918) 744-5145 or visit one of our three local Tulsa offices to discuss a Non Owners Insurance Policy or any other questions you might have regarding auto insurance.

Click to learn more about finding cheap non owner car insurance.

Click here for additional information on non-owners car insurance

ID Only Car Insurance

Finding ID only car insurance can be difficult and expensive. But here at Cheapest Auto Insurance we have companies who specialize in insuring customers with and ID only. Just because your license is not active does not mean you can't find affordable insurance. You just need to find the right company who specialized in ID only car insurance. We have found that nonstandard auto insurance companies are your best bet for cheap ID only car insurance. You will find these companies at your local independent insurance agency. These agents work with numerous companies to find you the cheapest rate possible. We have gone more in depth to provide you with all the information you will need to find the best ID only car insurance possible in the link below.

Click to learn more about ID only car insurance

Click to learn how to find cheap car insurance with an ID

How to get the best ID-only car insurance

Online car insurance quote comparison sites

Online car insurance quote comparison sites can be great ways to get a lot of quotes at one time. And as we have discussed many times that is one of the key ways to finding the cheapest auto insurance policy. The more quotes you get the cheaper your insurance is in most cases. If you do choose an online comparison site for your insurance needs it is important to remember that site in most cases is not your actual insurance carrier. They are the middleman and mostly just help you get the policy started initially and do not service the policy going forward. The insurance carrier they set you up with would be responsible for servicing the policy going forward.

Click here to learn more about finding cheap insurance from an online car insurance quote comparison site

Car Insurance Quotes Tulsa

Auto Insurance with a Suspended License

Finding cheap auto insurance with a suspended license can be very difficult. Auto insurance is expensive enough with a normal license let alone with a suspended one. A lot of insurance companies surcharge up to 4 points on an auto insurance policy for having a suspended license. This can raise your rates up to 30% on your monthly premiums. Insurance companies also look at the reason why your license is suspended and rate accordingly. Some auto insurance companies will even deny you coverage if your license is currently suspended. We have found nonstandard auto insurance companies are the best fit for drivers with a suspended driver's license. Drivers with a suspended license are considered high risk drivers as far as insurance companies are concerned. Here are a few auto insurance companies we found who offer affordable rates for drivers with a suspended driver's license:

- Save Money Car Insurance

- The General

- Safe Auto

- Venture

- Key

Click here to learn more about finding cheap auto insurance rates with a suspended license.

How to find cheap auto insurance with no license

Drivers who do not have a driver's license will pay more for their auto insurance compared to what the cost would be if they have an active license. But one major misconception about auto insurance is that people think you cannot get auto insurance without an active license, but you absolutely can. It’s going to be more expensive but it is very doable. Here are a few tips for you to help keep your auto insurance affordable if you do not have a license:

- Sign up for auto pay on your monthly payments

- Sign up for paperless billing

- Keep a clear driving record for 3 consecutive years

- Shop around at your renewal to make sure your current company is still the cheapest

- Keep active insurance for 6 straight months for prior insurance discount

- Get a State ID as a form of identification

These are just a few tips to help you get cheap auto insurance quotes without a license. The best thing you can do though is keep a safe driving for 3 years and get as many quotes as possible. The more quotes you get the better your chances of saving money on your car insurance premiums.

Click here to learn more about finding cheap auto insurance with no license

To learn more about finding auto insurance without a license click here

How to find cheap auto insurance online?

When getting online car insurance quotes, you need the same mindset as if you were speaking to an agent. First off have all your information ready so the quote can be accurate. Secondly, tell the truth so your quote will be accurate. Try to get as many discounts as possible, here are a few you can check when getting online quotes:

- Sign up for auto pay

- Sign up for paperless billing

- Take a defensive driving course

- Pay your policy In full for six months

-

Watch this video to learn more about auto insurance quote comparison sites

Some auto insurance companies offer a discount for doing the insurance online compared to speaking with an agent. So, if you understand auto insurance coverage this can be a very good option for you to save some money on your insurance. Just make sure you research the company you are looking at before you pay for the policy. The more research you do the better and the more quotes you get the chances of finding cheap rates will increase.

Click here to learn more about finding online auto insurance

Best Insurance Companies in Tulsa

There are many insurance companies in Tulsa to choose from. So, we want to help you find the best one to fit your needs. It is important to view customer reviews on the insurance company you are getting car insurance rates from. We have found one of the best ways to do this is reading the insurance company’s Google Reviews. This gives you a true look at what customers are saying about the specific insurance company you are looking at from the customer’s point of view. This will take your focus off solely looking at price but also weighing in customer experience to make your final decision. We know we are not perfect but as you can see by our reviews below, we do our best to take care of every customer and try to find them insurance in Tulsa at an affordable price regardless of driving record and insurance history. We would love to be your insurance provider, please check out our reviews below and see if we can help save you money on your insurance today

FAQ-Auto Insurance in Tulsa

Get Started Today

Cheapest Auto Insurance wants to be your neighborhood insurance partner in Tulsa. You can reach one of our agents via phone at (918) 744-5145 or get an instant online quote.

Other Resources

Oklahoma Auto Insurance Guide

E-Sign Accepted Here

We are happy to offer an e-sign option for anyone that can’t make it to an office to sign paperwork. We want to make the process as easy as possible for you.

Note All rate data is generated as part of The Zebra's industry-leading annual insurance rate study.

Other Useful Links:

Why Us?

See All Our Locations